do you pay tax on a leased vehicle

When you lease a car most states do not require you to pay sales tax on the cost or value of the vehicle. This means you only pay tax on the part of the car you lease not the entire value of the car.

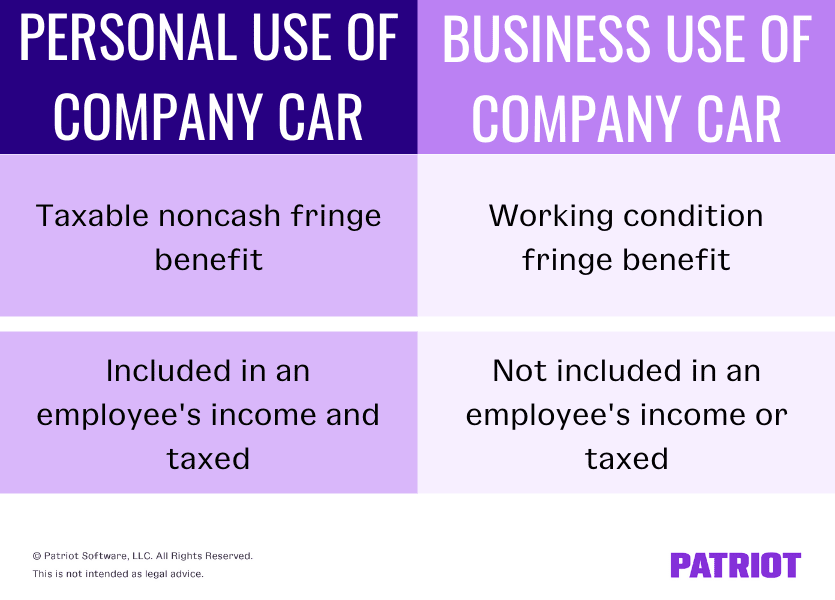

Personal Use Of Company Car Pucc Tax Rules And Reporting

Tax is imposed on the leasing companys Texas purchase of a motor vehicle and is due at the time of titling and registration.

. 64I and the Departments sales tax regulation on Motor Vehicles 830 CMR. However its more common to pay sales tax across each monthly lease payment. Article continues below advertisement.

This Directive clarifies the application of the sales and use tax statutes GL. If youre considering leasing you may be wondering whether you pay taxes on a leased car. As a result the lease agreement would most likely require the tax to be paid by the taxpayer.

In leasing you agreed to make a monthly. Even if the vehicle is not. Buys the vehicle at the end of the lease use tax is based on the balance owed at the time of lease pay-off.

When you buy out your lease. If youre leasing a car as a private individual through a personal lease you will be required to pay VAT value-added tax at a fixed rate of 20. Use tax is due.

A lease buyout which usually occurs at the end of your lease period is when you opt to keep your leased car rather than return it to the dealer. This means you only pay tax on the part of the car you lease not the entire value of the carFor example if your local sales tax rate is 5 simply multiply your monthly lease payment by 5. The monthly rental payments will include this.

Calculate Tax Over Lease Term. The local car tax is 1812 if the price is 18200 x 70. If you are a full.

Furthermore sales tax will be added to each monthly lease payment. For instance if your lease payment ends up being 500 a month and the leased car sales tax in. Tax is calculated on the leasing companys purchase price.

Sells the vehicle within 10 days use tax is due only. The most common method is to tax monthly lease payments at the local sales tax rate. To determine how much sales tax you will pay over the entire term of the lease simply take the tax amount found in Step 2 and multiply it.

When you purchase a vehicle you will have to pay sales tax on the entire value of the car. In Virginia you will be taxed upfront on the cost cap of the rented car 6 sales tax rate Fairfax County and then on the 415 tax rate based on the value of the car each year. The tax is paid up-front or rolled into financing at the rate of 70 of the fair market value of the vehicle as determined by the Georgia Department of Revenue or the.

For leasing unless you live in that handful of states your sales tax is based on the sum of your.

Poinciana Lease Returns Off Lease Vehicles Dyer Kia Lake Wales

Tax Deductions And Business Vehicle Leasing Veturilo

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

Buy Or Lease For Tax Purposes What S The Best Way To Own A Car Dentistry Iq

Leasing Mercedes Benz Financial Services Mercedes Benz Usa

Do Auto Lease Payments Include Sales Tax

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

How Is Sales Tax Calculated On A Car Lease In California Quora

Getting Lease Tax Money Back From Government Ask The Hackrs Forum Leasehackr

Refinancing A Leased Car How Why To Refinance Your Leased Car

New Business Vehicle Tax Deduction Buy Vs Lease Windes

/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Pros And Cons Of Leasing Or Buying A Car

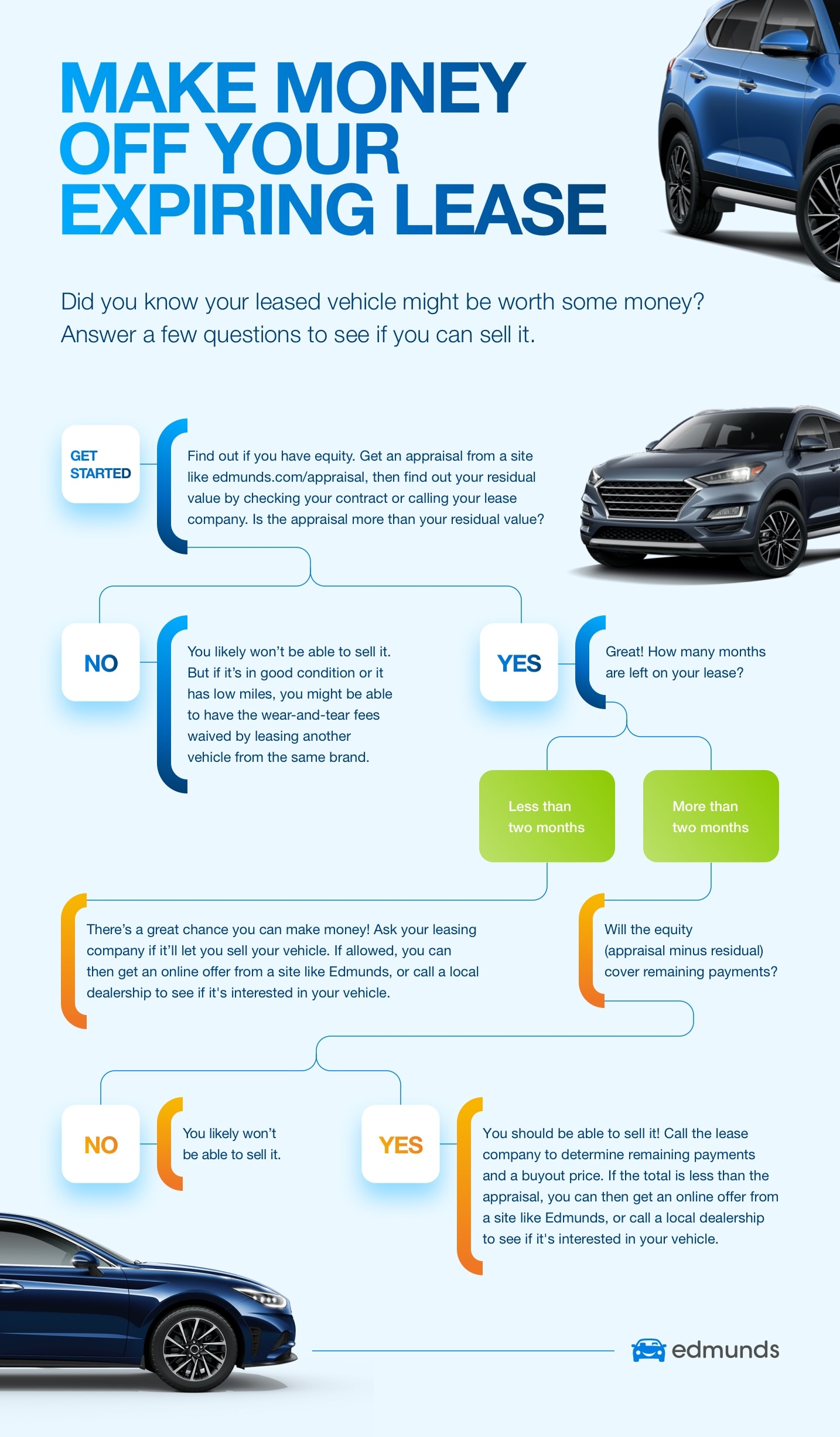

3 Ways To Turn Your Lease Into Cash Edmunds

Tax Advantages Of Leasing Versus Buying Fiore Toyota

Leasing Vs Buying A Car Which Offers More Tax Savings Turo Tax Tips

What Is Car Leasing And Is It A Good Idea Credit Karma

New Illinois Sales Tax Law Lowers The Cost Of Leasing A Car Chicago Tribune